Facts about EDS

Positive result for 2022

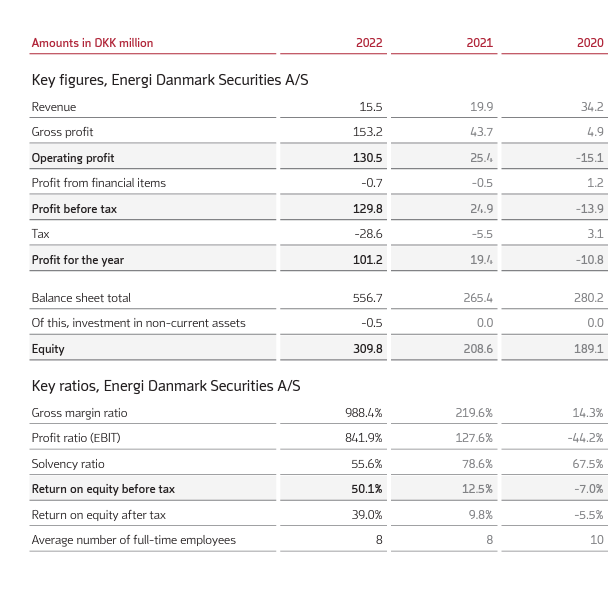

In 2022, Energi Danmark Securities delivered the best result in the company’s history with a profit before tax of DKK 130 million. This is a satisfactory result in a very difficult market. We have managed to maintain strict risk management for our customers, and they see added value in entering into result-oriented contracts, where both parties can benefit from the good results created on the basis of the hedging strategies we have prepared together.

The result for Energi Danmark Securities in 2022 is a milestone, as it shows what a good team of portfolio managers with many years of market experience can achieve in cooperation with our customers.

Based on the Nordic market for electricity, Energi Danmark Securities A/S offers portfolio management, portfolio agreements and trading in derivative financial instruments. The geographical business area primarily covers the Nordic countries and Germany.