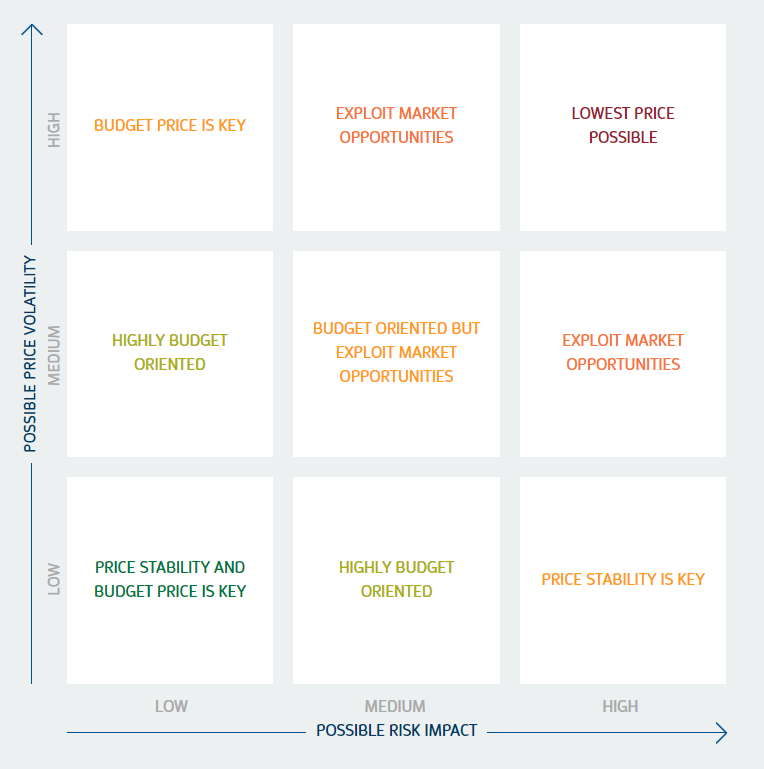

Strategy alternatives

Anchored in the risk management strategy which matches market opportunities with the company risk profile, we determine the most appropriate procurement strategy. We ensure that the strategy and the ongoing processes are implemented throughout the organisation resulting in added customer value for your company on every corporate level.

To each PM STRATEGY is attached standard product descriptions, but almost all PM STRATEGIES can be tailor-made to meet all specific customer needs on RISK/REWARD targets, hedging, trading and RISK levels.

All strategies include:

- Setup and management of monthly portfolio reporting

- Daily management of your positions

- Regular market analysis and assessments

- Monthly reporting

- Ongoing performance monitoring and comparison with the selected strategy

Click below to read about each strategy:

Contact Energi Danmark Securities